Uber became a well-known name in every household during the few short years of its existence. Given that Uber has an army of followers around the world, in the beginnings of that industry, everyone wondered what consequences it would leave on mandatory auto insurance. Fortunately, there are still no consequences, because they are also in Uber, but all its competitors they are aware of that concern. Transportation sharing services are covered by the same insurance policies as cars of individuals, which means that driving them is (almost always) safe and that you can count on compensation for possible physical injuries.

Uber’s ambition is to be present everywhere – in all advanced cities that need a safe, reliable, and efficient way to move through their city. Although often compared to a taxi, Uber is not a taxi, and the principles of operation and work techniques are significantly different.

What is important is that the uber business is constantly evolving and that insurance companies must follow this trend, and reject old traditions, introducing new insurance policies.

Only in the United States, there are millions of drivers who have seen the opportunity to make money as uber drivers. What is it really about? The Uber driver is a car registered as a “taxi,” but is actually an unmarked passenger vehicle. The person who wants this job registers, registers, goes through checks, which determine the technical correctness of the vehicle and everything else. After that, the driver enters the system with other drivers. Through the Uber App, customers request transportation, and those drivers who are closest to the location are notified.

Uber insurance

If you are wondering what kind of insurance drivers need, we will say that it is a combination of passenger and taxi insurance. This insurance should cover the cost of repairing the vehicle in the event of a minor breakdown resulting from internal factors of a mechanical, electronic, electronic, pneumatic, or hydraulic nature, due to which the vehicle is not in running order or it is not possible to operate the vehicle safely.

In addition, it must include the costs of assistance in the event of a breakdown, and the repair of the vehicle on site if possible. When we talk about a major breakdown, the assistant determines the type of breakdown, and the car is referred for repair, with the insurance bearing the costs of repair and replacement of parts. Of course, this varies from one insurance company to another, some covering the repair in full and most in part.

In principle, uber insurance should cover the insurance of vehicles, drivers, and passengers in it. You can learn more if you visit Quote Radar. Basically, there are several types of uber insurance to choose from, depending on what you consider appropriate. For example, there is an insurance policy that covers damage that is done exclusively by a third party. There is also one that will cover the damage in case of theft and even fire. Third, the best type of insurance is one that covers the entire damage regardless of the circumstances. Of course, it goes without saying that the accident was not intentionally caused and that the driver was not intoxicated, and that the insurance was paid regularly.

Uber is an evolving business, which must be followed by insurance companies, which need to discard old traditions if they want to make money on a booming sharing economy that is gaining momentum.

However, there is one thing that many uber drivers do not know, and that is that uber insurance can cancel your personal car insurance. In other words, when applying for uber insurance, you need to check if the insurance policy also covers private driving, because in most cases this is not the case. You’ll have to consider buying supplemental commercial car insurance, which for many Uber drivers, who only work part-time, may not even pay off. It needs to be checked. Uber provides some kind of automatic insurance only when the app is turned on. Uber requires that all their drivers have car insurance. And it provides additional insurance but only while the app is on.

How to use the uber application?

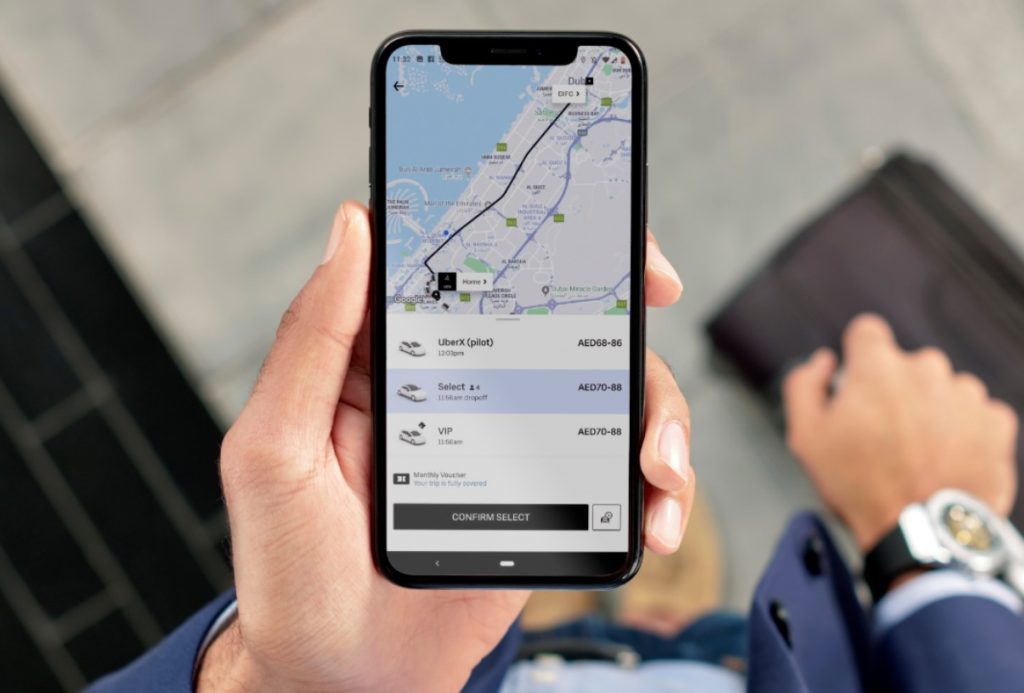

The Uber app works very simply. It first locates the client using GPS and then displays the nearest uber car and the time it can take to reach its destination. At that point, the client has access to the driver’s personal information, such as a picture, name, car type, and license plates. In addition, with the help of the application, the client can track the movement of uber to him.

Many are afraid of safety when it comes to uber driving, but there is no room for that here, because drivers pass the check, just like taxi drivers. It could be said that the checks are even stricter, as they also include checking the criminal history and driving experience before joining the platforms. Clients also have the option to share their travel route with friends so they would feel safer.

During each ride, the client rates the driver with a score of 1 to 5, which helps other users to make their choice. Uber complies with all applicable tax laws and pays the relevant taxes in all territories in which it operates. Each partner-driver is a professional driver and operates through their company or craft. As these are independent entrepreneurs, not employees, the partner drivers are themselves responsible for reporting and paying taxes and all contributions.

What has a special advantage over a taxi ride is the fact that, when scheduling a ride, you receive by email all the information about the route and its duration, as well as the price itself. So, there is no need to look back and take a look at the taximeter because you already know the price in advance.

Final thoughts

If you are considering making uber driving your job, whether additional or primary, uber insurance is definitely something you will have to think about, because otherwise, you will not have a chance for this job. It is important to note that many variables are looked at when taking out insurance – credit report, loss history, driving history, level of education, vehicle type, and so on.